29th September, 2025

Bank Exams

RRB PO vs IBPS Clerk Are They Same

Table of Contents

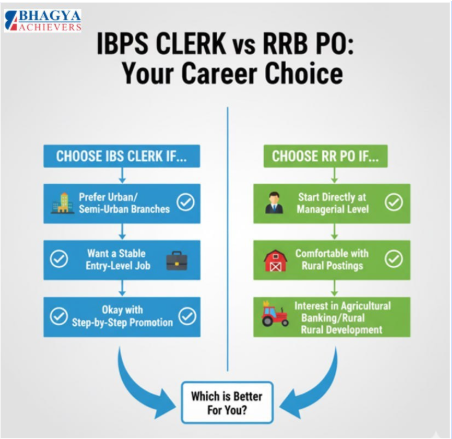

Many aspirants assume that the RRB PO and IBPS Clerk are the same, but this misconception can cost months of preparation. While IBPS Clerk and RRB PO bank exams are gateways to government banking jobs, IBPS Clerk prepares you for clerical operations whereas the RRB PO focuses on officer level responsibilities.

Knowing these distinctions will help you to target the right skills, strategize preparation, and secure your dream job.

What is an RRB PO Bank Clerk?

The IBPS RRB PO bank exam is conducted every year for the recruitment of Officer Scale I (Probationary Officer) in the Regional Rural Banks (RRBs). These banks mainly serve the rural and semi rural population, focusing on rural development, agricultural loans and financial inclusion schemes.

An RRB PO acts as a managerial clerk who supervises staff members, approves loans, ensures smooth working in branches and also helps in promoting schemes in rural areas.

What is the IBPS Clerk?

The IBPS Clerk bank exam is concluded by the Institute of Banking Personnel Selection to recruit clerks in Public sector banks. IBPS Clerks are the first point of contact for a customer, that's why they are called as frontline staff of a bank.

The main roles of the clerks are handling customer queries, issuing passbooks and statements, processing transactions and maintaining records.

IBPS Clerk or RRB PO Are They Same? Basic Comparison of Eligibility & Selection Process

|

Factor |

IBPS Clerk |

RRB PO |

|

Participating Banks |

Nationalized banks (except SBI) |

Regional Rural Banks |

|

Age Limit |

Minimum of 20 years and Maximum of 28 years |

Above 18 years & Below 30 years |

|

Educational Qualification |

Bachelor’s degree in any discipline from a recognized University or its equivalent |

Bachelor’s degree in any discipline from a recognized University or its equivalent |

|

Selection Process |

Prelims + Mains |

Prelims + Mains + Interview |

Key Differences in RRB PO and IBPS Clerk Bank Exam Are:

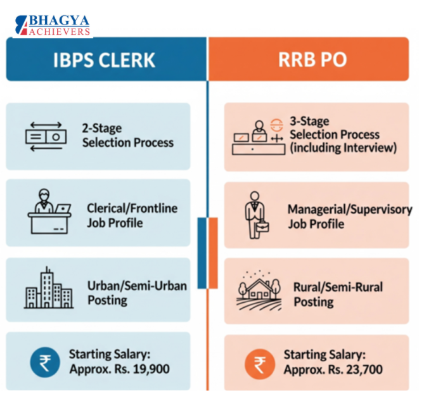

- IBPS Clerk Recruitment has 2 stages only prelims and mains

- RRB PO has an extra interview round, making the selection process quite hard.

- IBPS Clerk mainly leads to clerical roles, while RRB PO is a managerial role right from the start.

Also Check:

IBPS Clerk Quantitative Aptitude Preparation Guide

IBPS PO vs. SBI PO vs. RRB PO – Which One is Better?

IBPS Clerk or RRB PO Are They Same? Comparison of Salary & Allowances

|

Salary Comparison in RRB PO vs. IBPS Clerk |

||

|

Component |

IBPS Clerk |

IBPS RRB PO |

|

Starting Basic Pay |

Rs.19900 |

Rs.23700 |

|

Salary Structure |

Rs.19900 - 1000/1 - 20900 - 1230/3 - 24590 - 1490/4 - 30550 - 1730/7 - 42600 - 3270/1 - 45930 - 1990/1 - 47920 |

Rs. 23700 – 980/7 – 30560 – 1145/2 – 32850 – 1310/7 – 42021 |

|

In Hand Salary |

Rs. 29450 (approximately) |

Rs. 29000 to 33000 |

|

Allowances |

|

|

Key Differences among IBPS Clerk and RRB PO Bank exam:

- Basic Pay of the RRB PO is higher than that of an IBPS Clerk.

- In hand salary of the RRB PO and IBPS Clerk is almost similar, but the growth potential is higher in RRB PO.

- Both positions offer attractive perks such as allowances, retirement benefits and also medical facilities.

Also Check:

IBPS Clerk Salary in India: Complete Breakdown

IBPS RRB PO 2025: Detailed Syllabus and Exam Pattern for Prelims & Mains

IBPS Clerk or RRB PO Are They Same? Comparison of Job Profile & Probation Period

|

JOB Profile and Probation Period in RRB PO and IBPS Clerk |

||

|

Component |

IBPS Clerk |

IBPS RRB PO |

|

Job Profile |

|

|

|

Probation Period |

6 months |

2 years |

Also Check:

Common Mistakes to Avoid in IBPS Clerk Prelims

IBPS RRB Clerk Prelims Exam Analysis Trend of Last 6 Years

IBPS Clerk or RRB PO Are They the Same? Comparison of Career growth

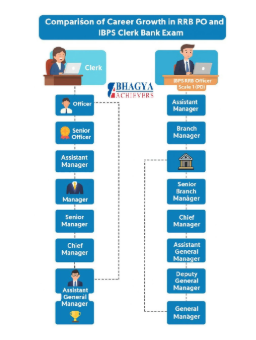

Key Insights – IBPS Clerk vs RRB PO

. Clerks may take longer to reach higher posts as compared to RRB POs, but promotions are regular and structured for clerks.

How to solve blood relation questions in IBPS RRB Clerk and PO Exam 2025?

IBPS Clerk or RRB PO Are They Same? Comparison of Promotion Aspects

|

IBPS Clerk or RRB PO which is Better? - Comparison of Promotion Aspects in RRB PO vs. IBPS Clerk |

|

|

IBPS Clerk |

IBPS RRB PO |

|

An IBPS Clerk promotion needs 2-3 years of service in some banks. Promotions are provided on two factors. Normal/Seniority process Merit – based/ Fast track process |

You will have the chance to get promoted to higher Manager posts only after the completion of 2 years of Probation Period. Banks conduct exams on a regular interval of time for the promotion of the employees. Also, the promotion can be on the basis of seniority. |

Key Insights: IBPS Clerk vs. RRB PO

- The RRB Probationary Officers must serve the probation period fully before moving ahead, but promotions lead to higher managerial roles faster.

- IBPS Clerks may take longer to reach higher posts, but promotions are regular and structured.

Also Check:

IBPS Clerk Mains: Topic-Wise Weightage & Scoring Strategy

IBPS RRB PO Prelims 2024 Exam Analysis

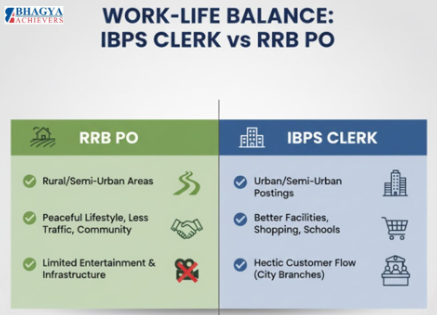

Work Life Balance: RRB PO vs. IBPS Clerk

Double Tab to Get Free PDFs of IBPS Clerk

Double Tab to Get Free PDFs of RRB Clerk

Difficulty Level of Exam: IBPS Clerk vs. RRB PO

RRB PO Bank Exam: Slightly tougher than IBPS Clerk because it includes an interview + decision making role.

IBPS Clerk Bank Exam: Easier in terms of selection because it ends with mains (No interview)

Also Check:

IBPS RRB PO Prelims and Mains Cut Off Trend for Last 6 Years

30-Day Study Plan for IBPS Clerk Prelims: Crack the Exam in One Month

IBPS Clerk vs. RRB PO – Which is better?

To Conclude:

Choosing between IBPS Clerk and RRB PO is not just about exams – it’s about your career journey and aspirations. Both paths offer growth, learning and prestige. Stay consistent, work hard and approach every challenge as a step toward your dream in the banking sector.

Frequently Asked Questions

Q1: Are Bank Exam RRB PO and IBPS Clerk are similar or Different?

Ans: No, the RRB PO competitive exam is a managerial post in regional rural banks, whereas IBPS clerk is a clerical post in public sector banks.

Q2: Which bank exam is tougher – IBPS Clerk vs. RRB PO?

Ans: RRB PO bank exam is tougher due to the additional interview round and managerial responsibilities included.

Q3: What is the educational qualification for both IBPS Clerk and RRB PO bank exams?

Ans: A bachelor’s degree in any discipline is required to crack both bank exams.

Q4: Who earns more between IBPS Clerk and RRB PO?

Ans: Bank RRB POs earn slightly more, with higher basic pay and growth potential.

Q5: What is the probation period for IBPS Clerk and RRB PO?

Ans: IBPS Clerk has 6 month probation period while RRB PO has 2 year of probation period.

Q6: Which bank job is better to choose from IBPS Clerk and RRB PO?

Ans: Choose RRB PO bank exam for faster career growth and IBPS Clerk for stability and balance.

Also Check:

- IBPS PO vs IBPS Clerk: Which Banking Career is Better?

- IBPS Clerk vs. IBPS PO: Which Exam is Easier to Crack?

- Is an IBPS Clerk a government job?

- Toughest Bank Exam in India: Which One is the Hardest to Crack?

- 30-Day Study Plan for IBPS Clerk Prelims: Crack the Exam in One Month

- How to Tackle Quantitative Aptitude in IBPS Prelims: Speed, Accuracy & Shortcuts

- General Awareness for IBPS Mains – Best Sources & Weekly Revision Plan

Bhagya Achievers

Bhagya Achievers